Previous

Why it may be time for an Incident Response Plan

Are You Prepared?

With a score of 5.99 on the 2020 Basel AML Index, Jamaica is among the top ten countries in Latin America and the Caribbean, with the highest risk index of money laundering and terrorist financing.

As the world moves forward, regulatory regimes are constantly evolving to meet this rise of money laundering and financial crimes. Financial Institutions (FIs) must therefore have a comprehensive sanctions screening procedure in place to investigate and remediate any potential suspicious relationships, automate the reporting of suspicious activities and assist in the discovery of any illegal activity to which FIs may be exposed.

As documented by the Wolfsberg Group, sanctions screening is a control employed within FIs to detect, prevent, and manage sanctions risk. Sanctions screening can be deployed during customer onboarding as well as to detect transactions done by sanctioned customers. Not only should organizations be using regularly updated lists, but they should also have procedures in place to screen existing customers regularly (including Politically Exposed Persons - PEPs) to ensure that there is no change in the status of the customers.

Screening is typically done against internal lists maintained within the entity as well as publicly available Watchlists (such as the UN and Office of Foreign Assets Control (OFAC) sanctions list) or subscribed to through entities such as Refinitiv and Dow Jones.

There is no 'one size fits all solution for sanctions screening that is appropriate for all institutions. The needs are determined by the organization's risk appetite and the regulatory environment in which it operates.

Sanctions screening has become an essential aspect of cross border transactions, and banks may refuse to do business with another bank if proper processes are not in place.

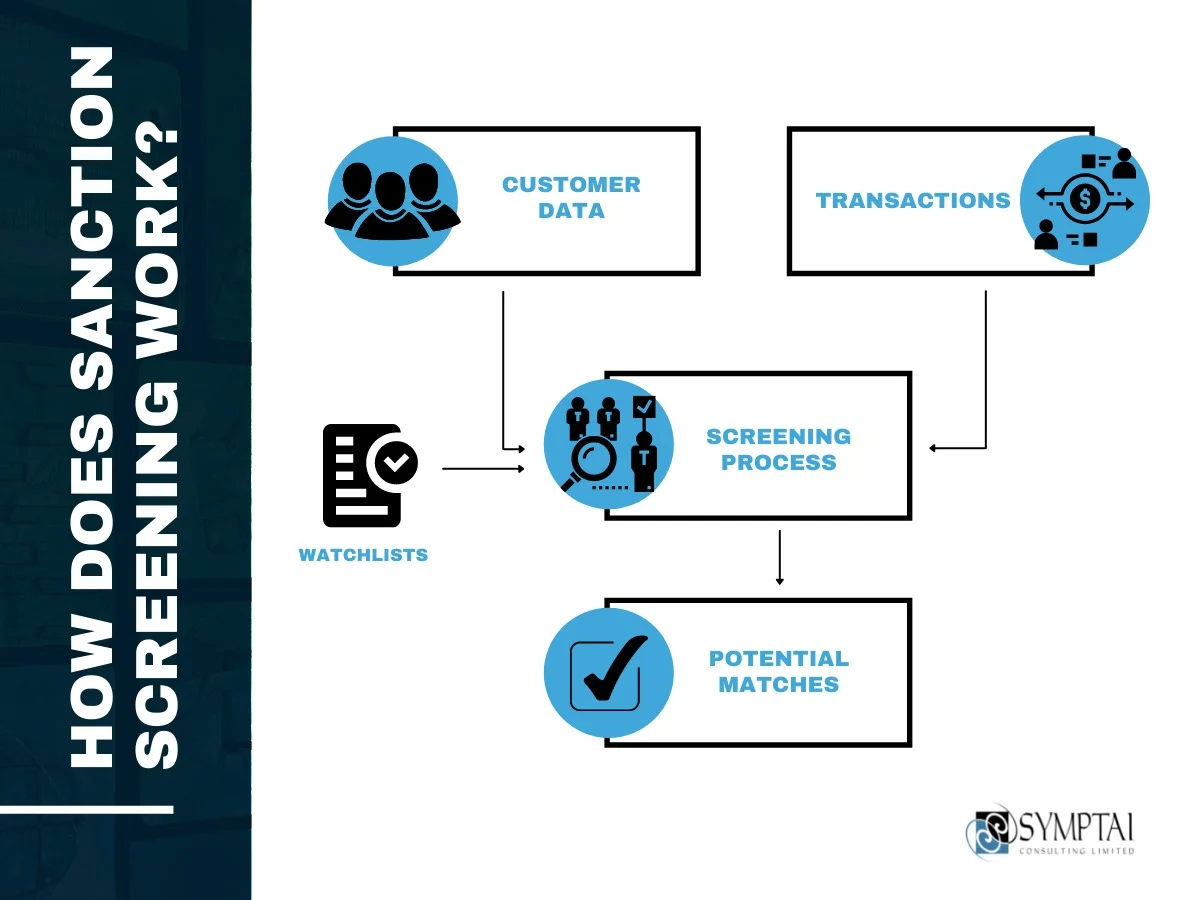

The following diagram provides a very simplified view of the process.

Financial institutions send their client data and the parties involved in a transaction to a screening service, which compares them to watchlists to see whether any matches exist. Several parameters, such as name, date of birth, and country, can influence the match percentage.

Potential matches may be returned, which can then be confirmed or ruled out as false positives.

Any confirmed matches are then passed to the Risk and Compliance function to determine the next step.

Here are some factors to consider when screening an individual against sanctions lists.

Use the updated versions of the lists and constantly assess the accuracy of the list.

The lists should have the ability to handle common prefixes, secondary names, suffixes and non-Latin characters

The entity should meet regulatory requirements while also satisfying its internal risk appetite.

Also, keep in mind OFAC's 50 Percent Rule when looking at entity ownership.

Given the regulatory regime and technicalities or complications that can arise going through compliance procedures, we arrive at the question: Are you prepared?

Are you prepared to meet the ever-increasing regulatory demands?

Do you have a sanctions screening program in place?

Do you have controls in place to periodically check for list updates?

Are your sanctions screening methods/software adequate, continuously tested, and calibrated to ensure that risk is appropriately mitigated?

Are you following the best practices when using sanction/watch lists?

Are you comfortable with the frequency at which screening is done within your organization?

Our recommendation for an institution attempting to answer these questions is to investigate the implementation of a system that can assist with managing the necessary procedures in a realistic, timely, organized, systematic, and cost-effective manner. As there is an inherent risk in doing business with a person or entity on a blocklist or sanction list, the proposed system should ensure that when implementing/maintaining a regulatory compliance procedure, it can also manage your risk appetite for seen and unforeseen risks. Non-compliance with regulatory controls, even unknowingly, will expose the organization to damaging reputational risk and be liable on conviction to significant fines.

"Ignorantia Juris Non Excusat" - Ignorance of the law excuses not

Instead of ad-hoc compliance procedures or finding a way to evade the sanctions, we encourage you to do your due diligence. If your team lacks the necessary knowledge or resources, Symptai is here to support you. Our Alessa platform contains all the anti-money laundering (AML) capabilities required by banks, money services businesses (MSBs), FinTechs, casinos, and other regulated industries.

To discover more about how Symptai can help your organization manage compliance, contact us. To learn more about our screening solution click here.